Diminishing depreciation formula

Diminishing value method. It uses a fixed rate to calculate the depreciation values.

Depreciation Methods Principlesofaccounting Com

The DB function performs the following calculations.

. 2000 - 500 x 30 percent 450. This accelerated depreciation method allocates the largest portion of the cost of an asset to the early years of its useful lifetime. And the residual value is.

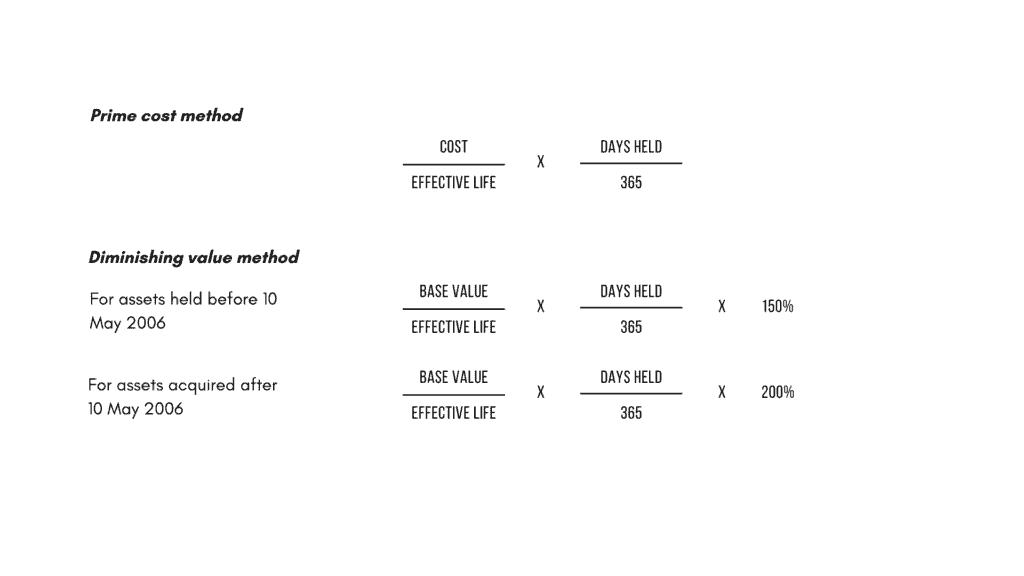

When using this method assets do not depreciate by an equal. 1750000- Depreciation rate 12. Carpet has a 10-year effective life and you could calculate the diminishing value depreciation as follows.

Cost value diminishing value rate amount of depreciation to claim in your income tax return The assets new adjusted tax value is its cost value minus how much depreciation youve. Another common method of depreciation is the diminishing value method. Plugging these figures into the diminishing value depreciation rate formula gives the following depreciation expense.

Some of the merits of diminishing balance method are as follows. A company has brought a car that values INR 500000 and the useful life of the car as expected by the buyers is ten years. Recognised by income tax.

Fixed rate 1 - salvage cost 1 life 1 - 100010000 110 1 -. If you use this method you must enter a fixed. Depreciation Rate Depreciation Factor x Straight-Line Depreciation Percent Depreciation for a Period Depreciation Rate x Book Value at Beginning of the Period If the first year is not a full.

In this lesson we explain what the straight line and diminishing balance depreciation methods are show the formula for calculating the depreciation methods. The rate of Depreciation 10 Year ending 31 March. Depreciation amount book value rate of depreciation100.

The diminishing balance method of depreciation or as it is also known the reducing balance method calculates depreciation as a percentage of the diminishing value. Year 1 2000 x 20 400 Year 2 2000 400 1600 x. Diminishing Balance Depreciation is the method of depreciating a fixed percentage on the book value of the asset each accounting year until it reaches the scrap.

Diminishing Balance Method Example. 80000 365 365 20 16000 Note that if you acquired the above asset part way through the year the final calculation using the prime cost method should occur. Formula to Calculate Depreciation Value via Diminishing Balance Method The formula for determining depreciation value using the declining balance method is-.

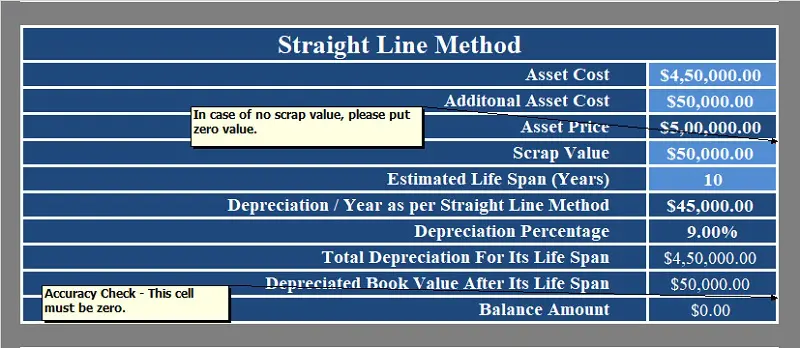

Under the straight-line depreciation method the company would deduct 2700 per year for 10 yearsthat is 30000 minus 3000 divided by 10. Solution The solution is given below Total cost cost of machinery transportation installation 1500000 175000 75000 Rs. So Total Cost of an asset 110000015000050000 Rs 1300000- The following table shows the year by year.

Depreciation Formula Calculate Depreciation Expense

Solved I M Trying To Calculate For The Diminishing Rate On Chegg Com

1 Free Straight Line Depreciation Calculator Embroker

Method To Get Straight Line Depreciation Formula Bench Accounting

Diminishing Or Reducing Balance Method Of Depreciation Ilearnlot

Depreciation Formula Examples With Excel Template

Download Depreciation Calculator Excel Template Exceldatapro

Depreciation Straight Line Method Or Original Cost Method Lecture 1 Youtube

Diminishing Balance Method Of Calculating Depreciation Also Known As Reducing Balance Method Accounting Simpler Enjoy It

Depreciation Formula Examples With Excel Template

Double Declining Balance Depreciation Calculator

Depreciation Calculation

Double Declining Depreciation Efinancemanagement

Calculating Depreciation Youtube

Diminishing Balance Depreciation Method Explanation Formula And Example Wikiaccounting

Depreciation All Concepts Explained Oyetechy

Working From Home During Covid 19 Tax Deductions Guided Investor